If you’re an active trader, you’ve probably experienced it – your strategy works, the market moves in your favour, but the final profit still looks smaller than what you expected. In the fast-growing crypto market, that gap often comes down to fees.

As more traders enter the crypto F&O space and crypto exchanges try to keep up with the demand, it all comes down to how much of each win stays in your account after fees.

India leads the global crypto adoption. The country’s crypto market is on track to cross 127 million users this year – a clear sign of growing trust, awareness, and participation among retail and institutional investors.

As participation grows, many exchanges roll out advanced features, but trading prices are starting to matter more than products for active traders.

This is where Indian crypto exchange, Delta Exchange, steps in with its comprehensive product suite and low crypto F&O trading fees.

This post will break down Delta’s pricing structure and why it’s among the top choices for many crypto F&O traders.

About Delta Exchange

Delta Exchange is a leading Indian crypto exchange that focuses on derivatives rather than spot trading. You can trade Bitcoin, Ethereum, and other crypto derivatives contracts (futures and options) with advanced tools and features.

By registering with the Financial Intelligence Unit (FIU) of the Government of India, Delta adds a layer of compliance for local traders. Delta supports INR deposits and settlements, providing Indian users with a familiar base for margin and profit/loss calculations.

If you’re new to crypto derivatives and want to navigate the market, Delta Exchange would be a safe platform to try.

The Real Cost of Trading Crypto Derivatives

High trading fees can eat into your trades over time. On many platforms, crypto F&O charges can go as high as 0.3% to 0.5% per order, and that’s before tax, settlement costs, or slippage come into the picture. For traders, those numbers add up fast.

This is why fee control matters as much as picking the right crypto trading platform. A structure built with traders in mind keeps costs affordable. That’s where Delta Exchange’s pricing model makes a real difference in the market.

What Are the Crypto F&O Fees on Delta Exchange

Delta Exchange keeps its crypto F&O pricing easy to track for those who trade Bitcoin or altcoin contracts on this Indian crypto exchange.

Here’s how their trading fees look:

- Futures

- 0.05% taker fees

- 0.02% maker fees

- Options

- 0.010% – both taker and maker fees

18% GST applies to all trading fees, and option charges are limited to 3.5% of the option premium.

The liquidation fees for crypto F&O are:

- Options

- BTC: Minimum of 20% X Premium and 0.05% X Notional size

- ETH: Minimum of 20% X Premium and 0.10% X Notional size

- Futures

- BTC: 0.05%

- ETH: 0.10%

- Others scale from 0.10% to 1.00% based on leverage.

18% GST applies to liquidation fees on the platform.

- Deposits and withdrawals carry 0% charges, keeping fund movement simple and cost-effective for all traders – whether newcomers or experienced.

An example of how option fees work on Delta Exchange

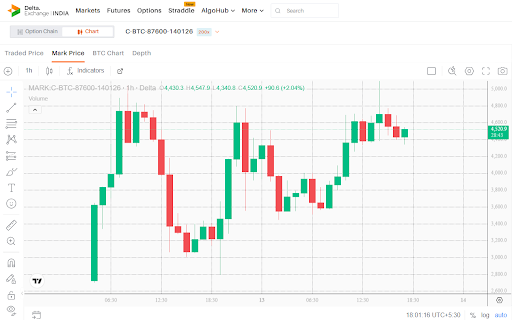

Crypto F&O market: Trade BTC options on Delta

Say you buy 100 BTC option contracts as a taker. Each contract has a lot size of 0.001 BTC, and BTC is trading at $100,000.

That puts the notional value of your trade at: 100 × 0.001 × $100,000 = $10,000

Now let’s look at the fee.

Delta charges 0.01% on options trades, so: $10,000 × 0.01% = $1

There is also a cap based on the option premium. With a premium of $300, it works out to be $1.05.

Since the actual trading fee ($1) is lower than the cap ($1.05), the lower amount applies.

After adding 18% GST, the final fee comes to: $1 × 1.18 = $1.18

So on a $10,000 BTC options trade, the total cost is just $1.18.

Delta’s Product Suite for Serious Crypto F&O Traders

For traders who are interested or active in the crypto F&O market, Delta Exchange brings together a set of tools that make planning, execution, and risk control far easier:

- You can trade options on BTC and ETH and futures on 100+ altcoins.

- Payoff charts show risk, breakeven levels, and profit zones before you place an order.

- Algo trading bots help automate entries, exits, and strategy execution more conveniently.

- Demo mode lets you test your trading ideas without using real money at the start.

- Hedging and portfolio diversification support better risk control across positions.

- A leverage of up to 200X gives you greater margin flexibility but also increases risk.

You can trade in INR, so you don’t have to deal with currency conversions on every trade.

Our Final Take on Delta Exchange

If you’re serious about trading crypto F&O, you already know how much small details shape long-term results. Fees, tools, and ease of use all stack up over time.

Delta Exchange prioritises transparency, keeps costs in check, and gives you the right setup to plan trades with confidence. From INR-based accounts to trading bots, it feels built for crypto derivatives traders who want more control.

To start trading crypto derivatives, visit www.delta.exchange. You can also follow Delta on X for the latest updates.

Disclaimer: Cryptocurrency markets are subject to high risks and volatility. Kindly do your own research before investing.