Adrian Vidal

In my previous Iris Energy (NASDAQ: IREN) article for Seeking Alpha, I mentioned my belief that the company should consider flipping its Treasury outlook from a 100% production seller to some sort of hybrid model. This belief stems from the fact that bitcoin supply emission has been the biggest driver of miner revenue thus far. Thus, with a block reward happening overnight in less than a year, all BTC miners theoretically benefit from holding BTC on balance sheets to profit from the theoretical increase in the coin’s price.

look into bitcoin

Bitcoin price has a history of rising after halving events. This is a somewhat critical part of coin creation because without higher coin prices, the miners processing transactions and securing the network would see revenue decline if a constant USD-denominated fresh supply were the only source of income. Is. This is theoretically while the input cost remains unchanged. This is not a good recipe for long-term success, but has recently been a catalyst that could offset the impact from the decreasing block reward emissions.

HODLing may not be necessary

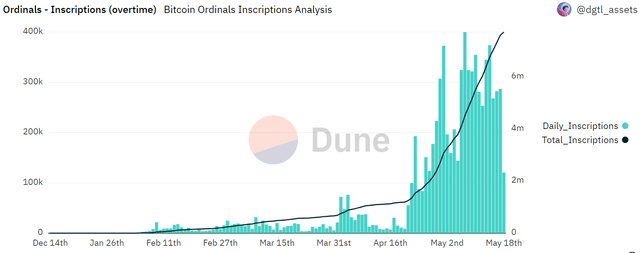

In a previous article covering BitFarms (BITF), I explained some of the recent developments regarding the Ordinals NFT protocol and the impact NFTs on the block space are having on bitcoin transaction fees. I won’t rehash that section here, but the main takeaway is that ordinals lead to higher transaction fees for miners and that protocol’s staking has continued to make new highs in recent weeks:

Ordinal Mints (Dune Analytics/dgtl_assets)

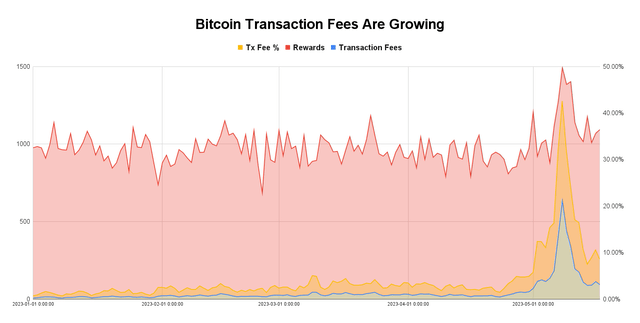

I detailed why I thought Ordinals had the potential to lead to a fee war within the bitcoin community in early February, and that assessment is close to coming to fruition. Regardless of whether or not everyone within the bitcoin community likes the ordinal, the potential stickiness of transaction fees is an important fundamental development for miners. Despite short-term spikes in fees over the years, the industry has remained almost entirely dependent on fresh BTC supply emissions from the block reward. We can see the impact of the transaction fee hike in May in the chart below:

intoblock

Between January and April, the share of bitcoin miner rewards coming from transaction fees averaged around 2.4%. During the first half of May, it has averaged over 17%. While there are some obvious outlier days on May 8th and May 9th that are helping to drive this increase in transaction fee share, even if we take those two days as an average we still get a total reward of about 14. Get transaction fee share. % for the month of May.

Let me be clear that I am not saying that Ordinals or BRC-20 tokens will cause transaction fees to continue to be high. But I would even go so far as to say that some potential model adjustments need to be made for miners to remain profitable in the long run. This is an idea that has been explored before by analysts who are much smarter than me. In my personal view, the simplest approach may be one that aligns with the free market mindset that I believe most bitcoiners have; Market participants need to start charging more realistic fees only for the service they are using.

survive the crypto winter

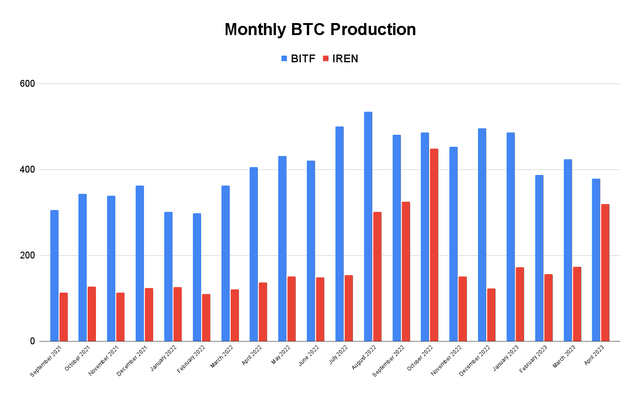

Things were looking very bad for the bitcoin mining industry in Q4-22 and Iris Energy was no exception. After scaling from 1 EH/s in March 2022 to around 4 EH/s by October, the crypto market turned against the sector and Iris had to seize machines placed through special purpose vehicles. It documented a dramatic month-on-month drop in Iris’ BTC production from October to November last year:

IREN Vs BITF (Company Disclosure)

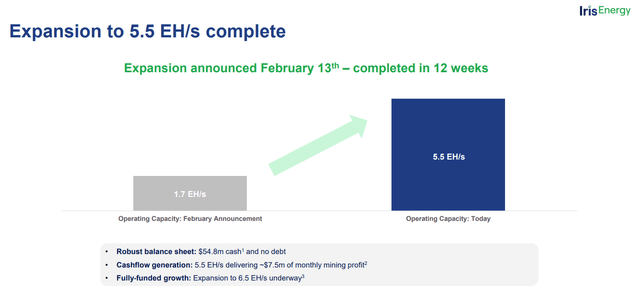

While it was unfortunate that the company missed out on 5 months of BTC mining revenue when the coin was staging a recovery, Iris structured the machine collateralization in a way that allowed the company to live another day and try again. Got permission. The company had 4.0 operating EH/s at the end of April. In form of May 10, Iris has 5.5 EH/s. In my view, this expansion of capacity in such a short span of time is impressive and encouraging.

Iris Energy

Iris is expected to bring another 1 Eh/s of operational capacity, most of which is at the company’s Childress site. Scaling up Iris Projects will require an additional $35 million in capex. CEO Daniel Roberts noted on the last quarterly conference call that the machines needed to bring on the additional EH/S have yet to be purchased and that the company is being patient with those purchases:

In terms of anticipated CapEx, we have not bought miners at this stage. We will consider doing so. Over time, we don’t see the urgency. We can give some guidance on what that might cost. There are some recent market benchmarks that people can refer to. We want to buy BITMAIN S-19 XP Mine on priority basis.

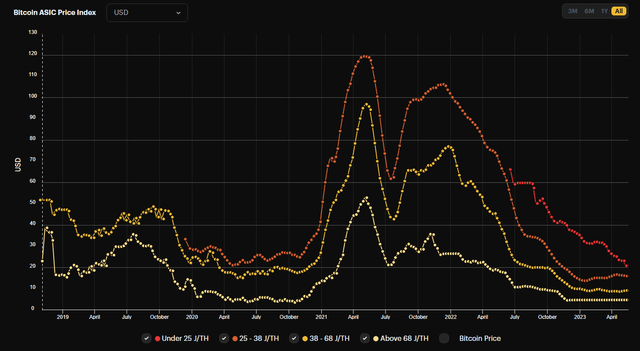

hashtrendindex

Fortunately, ASIC prices are still cheaper than at any time last year, and Iris has the cash to finance this additional EH/S scaling without taking on debt. Finally, the company has proven to be in a class of its own when it comes to maximizing efficiency:

| Miner YTD Metrics | btc production | Average BTC per EH/s |

|---|---|---|

| Iris Energy | 820 | 94.3 |

| CleanSpark (CLSK) | 2,395 | 90.1 |

| HIV Blockchain (HIVE) | 1,065 | 90.0 |

| bitfarm | 1,676 | 87.5 |

| Bit Digital (BTBT) | 447 | 87.4 |

Click to enlarge

Source: Company Disclosures

Year after year, Iris Energy has proven to be the most efficient miner in the space based on average BTC mined per EH/s. I expect this to continue given the company’s intent to buy S19 XPs.

risk

To date, Iris Energy has not been a profitable business. As currently built, the company is highly dependent on the price of bitcoin and consumer demand for BTC. Much has been thrown at bitcoin over the past 12 months and it seems clear that US-based regulators are in the “fight them” phase of the crypto story. This could theoretically reduce the demand for BTC and negatively impact Iris Energy stock.

Investor Takeaway

The crypto winter has been disastrous for many bitcoin miners in the public equity markets. We have seen many examples of solvency issues, bankruptcies and drastic reduction in production. Despite the hiccups in Q4, Iris Energy structured its obligations in a profitable manner and seems to have come out on the other side as one of the top companies in the industry.

To me the combination of Xash growth and mining efficiency makes IREN a buy for bitcoin miner stock holders. While I was a bit skeptical of Iris Energy’s BTC treasury management approach at first, if there is long-term stability for BTC transaction fees, securing the network could theoretically be a profitable business, even when fresh supply is released. From the reward is halved the next year. I’ve again taken a bit long and will try to plug any weaknesses in the near future.

source: seekingalpha.com